Why Invest in Gold?

There are many advantages to owning gold. Adding a gold component to your portfolio can considerably reduce your overall portfolio volatility, create a hedge against economic downturn, and add a tremendous opportunity for gain.

For an individual planning for retirement, whether you are considering investing in gold for small savings or a more substantial long-term investment, buying gold into a self-directed IRA can help protect your wealth and can increase risk-adjusted returns. Having a modest amount of gold within a balanced retirement investment portfolio can potentially reduce the overall risk of the portfolio, helping to protect against downturns in the stock market.

Gold has also become more accessible to retirement investors, due to the development of a wide range of investment products, such as a Gold IRA, that investors can include in their retirement savings portfolio. The diversity of a retirement investment plan with a precious metal IRA that includes IRS approved precious metal products (such as gold, silver, platinum, and palladium) means that gold can be used to enhance and create a wider variety of individual investment strategies and risk tolerances.

Here at Advantage Gold, one the top Gold IRA companies in the industry, we believe that having a self-directed IRA backed by IRS approved gold coins, bullion and bars and other approved precious metal products is a sound diversification of anyone’s retirement portfolio and a major reason someone should consider investing in gold as part of their retirement planning.

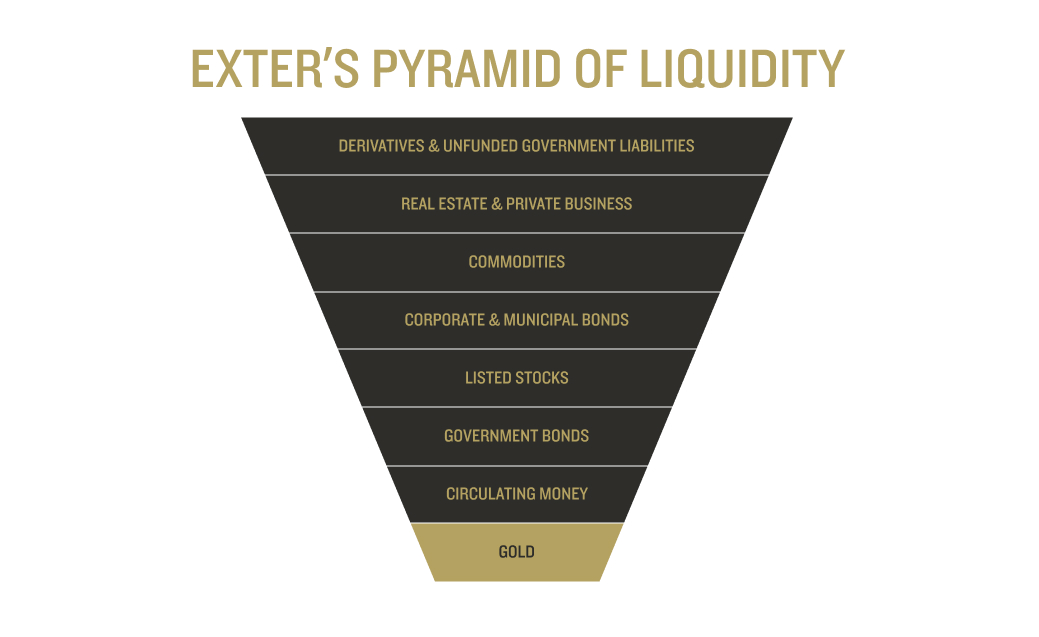

Exter’s Pyramid of Liquidity

Exter’s Pyramid of Liquidity displays the liquidity of assets in a hierarchy: From the most illiquid assets, complex derivatives and real estate, the pyramid progresses to the most liquid asset, physical gold.

The Difference Between Physical Gold, Gold Stocks and Gold ETFs

With so many investments in the gold arena, how do you choose whether to invest in exchange traded funds (ETFs), mining stocks, or physical gold?

PHYSICAL GOLD

Physical gold carries no counterparty risk, cannot be printed at will by any central bank, and is physical property that cannot be diluted. Physical gold and silver have stood the test of time for thousands of years and maintain value in the face of inflation, market volatility, political turmoil, currency devaluation, threats of terrorism, and war. While inflation and the constant devaluation of paper currency wither away purchasing power, precious metals act as powerful pillars of protection and shield against these corrosive forces.

One of the primary reasons to own gold is that it acts as a diversifier that is inversely correlated with the stock market. Gold is supposed to act as insurance for your portfolio when the economy crashes. Gold ETFs, however, negate the diversification benefit of gold because it is highly dependent on the banking system.

Physical gold, of course, doesn’t need a team of intermediaries to determine its spot price. This price is intrinsic to the laws of supply and demand. The additional dealer premium added to the price reflects the cost of changing the raw ore to a finished gold bar or coin and markup charged by the dealer to pay for costs of the business. In addition, there are potentially no reporting requirements when buying or selling physical precious metals.

We believe the status quo of record-high stocks and ultra-low interest rates is unsustainable. Politicians have made no progress in addressing the rapidly increasing government debt. Real wages remain stagnant, labor productivity has sunk, and manufacturing indices are weak. In the case of government default, the dollar and stock market could plummet in a crisis that could only be compared to the Great Depression.

In a crisis that expanded from a market crash to a dollar collapse, physical gold will not only retain its value, but appreciate in value. Gold and silver coins and bars could be used as a medium of exchange to replace a worthless dollar. With physical gold, an investor would be prepared if the worst scenarios came to pass.

For those who are looking to preserve their capital in today’s unprecedented economic climate, a long-term investment in gold would be the best choice. In the event of a market crash, physical gold affords the most security and more options.

GOLD STOCKS

The category of gold stocks usually includes stocks and mutual funds comprised of companies that produce, refine, or explore for gold. Gold stocks have benefited tremendously from the meteoric rise in the prices of precious metals since the turn of the 21st century. Although some of these companies have earned extremely attractive returns over the years and continue to show promise, they simply are not the same as an investment in physical metals.

Investors that buy a gold mining stock bet on that company’s ability to make profits regardless of the price of gold. If the price of gold goes up but the costs associated with running that particular company also increase, then the mining company’s stock could actually decline in value. The values of exploration companies’ shares reflect those companies’ efficiencies and their ability to find gold. They are not a simple reflection of the actual gold price.

Many mining companies operate in countries with significant political risks. Multinational mining companies such as AngloGold Ashanti, for example, were forced to cease operations when all of South Africa’s mining workers went on strike. This led to a precipitous decline in the stock price.

Gold stocks are also more volatile than physical gold. They can function as leverage proxies for gold – meaning that they outperform physical gold on the upside and underperform physical gold on the downside. In addition, technical analysis shows that gold stocks are more closely correlated to the stock market than physical gold, diminishing the purpose of gold as a diversification tool. While gold posted an annual gain during the panic of 2008, the benchmark HUI gold stocks index lost 27% of its value.

Investing in individual stocks takes a lot of careful preparation, study, and research that is entirely detached from the analyses of the overall gold market. We recommend that you speak with a licensed securities professional before you venture into this speculative arena.

ETFs

An Exchange-Traded Fund (ETF) is similar to a mutual fund in that it tracks an asset or an index of assets. A gold ETF may hold various gold assets, including stocks in mining companies as well as gold reserves. Investments in Exchange-Traded Funds have soared in popularity since the turn of the century. The most popular gold ETF is SPDR Gold Shares Exchange Traded Fund, traded as “GLD”. The most popular silver ETF is traded under “SLV”.

It is a misconception that only gold is used to support GLD, however. In addition to 400-oz gold bars, cash is also used. The gold that backs this ETF is stored at HSBC vault in London. Total capital invested in ETFs has risen from several hundred million dollars in 2003 to over $2 trillion today with an astonishing $15 trillion projected by 2023. That’s A LOT of paper!

So how does the price of a gold ETF keep in sync with the price of gold itself? “Authorized dealers” that have entered agreements with the trustee and sponsor required to buy and sell gold bullion in response to changes in the spot price. Generally, only mega-banks, such as Citi, JPMorgan Chase and Merrill Lynch-BOA, are permitted buy the gold ETF to act as authorized dealers. The constant functioning of these banks is essential for the ETF. A temporary cessation of operations at one of the “authorized dealers” would damage the liquidity of ETFs because the market operations that are always needed for GLD to reflect the price of physical gold.

ETFs offer fluidity in trading. ETFs are a favorite tool for high-frequency traders, allowing them to quickly move in and out of positions multiple times a day. ETFs also offer the advantage of being able to participate in a particular arena (precious metals) without having to take physical ownership of any asset.

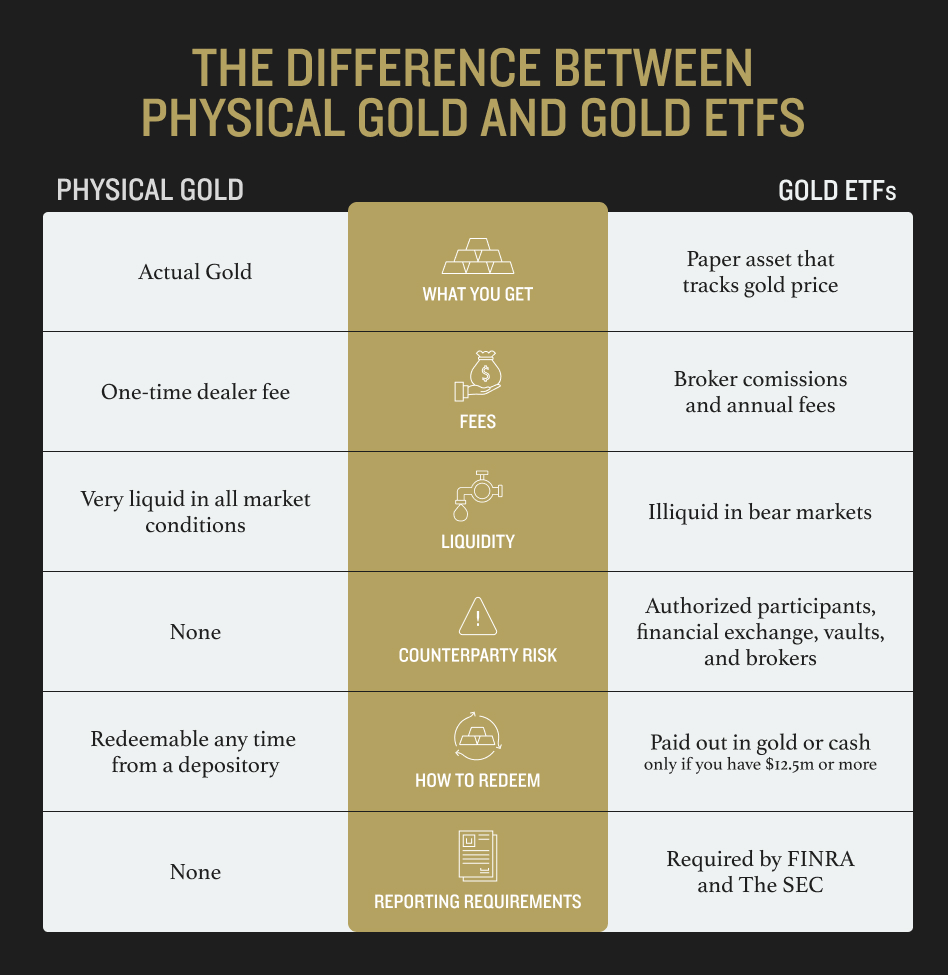

While the benefits of owning Gold ETFs may sound attractive, they have several detrimental qualities in relation to holding physical gold:

1. No Physical Possession

While Gold ETFs are made up of contracts and derivatives, which are redeemable for cash, at no time do you actually own a gold coin or a bullion bar. There is no option for physical redemption of your ETF shares for the typical investor. A common misconception regarding redemption of ETFs is that your GLD shares represent a claim on the underlying asset, gold. GLD shares are managed so that they trade at about 1/10th of an ounce of gold.

Authorized participants (the major Wall Street banks) or redemption orders in excess of 100,000 shares, or $12.5 million, are the only redemption requests that would be valid. Yet this does not mean that even this elite group has the power to redeem their shares for gold. GLD retains the option to always settle shares in cash and any private redemption must first be approved by the authorized participants.

2. Counterparty Risk

The banking system needed for the ETF creates a significant counterparty risk for investors in gold ETFs. Alternatively, physical gold you possess has no counterparty risk because its value is intrinsic. If your gold is stored in a private depository, the vault is the only counterparty risk. These vaults are insured for large amounts (DDSC provides $1 billion insurance) and are not dependent on any bank for their functioning.

3. Short-term Investment Horizon

The intraday trading opportunities created by ETFs may not fit into a long-term investment strategy, solely benefitting short-term ETF traders. As an investor, it will be important to lay out your investing goals before you decide how ETFs fit in your portfolio.

ETFs, similar to mining company stocks, do not provide any real physical security.

4. No Liquidity in Market Crash

Trading was temporarily suspended in the most difficult moments of the Great Recession. ETF investors were locked in at a price and were unable to sell their shares. In the event of a total bankruptcy of an authorized participant, your GLD shares could become worthless. Your GLD share is only worth something as long the banks that comprise the SPDR Fund are functioning. Creditors and depositors would rank far higher in terms of seniority in the case of liquidation of the bank. You could also attempt to be compensated by the Securities Investor Protection Corporation (SIPC).

5. Wealth-Corroding ETF Fees

Even if investors can overcome the fear of the significant systemic risks- they are still burdened with management fees for the ownership of ETFs. These fees will continually cause the ETF price to negatively diverge from the bullion price over time.

Typically, gold ETFs will charge 0.40% as expenses and fees annually in addition to a transaction commission. On the other hand, a bullion purchase will cost a dealer premium that is paid only once. This means that, in the long-run, gold bullion will always outperform the returns from gold ETFS.

Paper Wealth vs. Real Wealth

ETF shares are supposed to be backed by the physical metal. Shareholders don’t own title to the metal itself but instead are effectively entrusting their wealth to the mega-banks that serve as the primary custodian for the ETF’s bullion. With the recent collapses of giant financial institutions such as Lehman Brothers, MF Global, IndyMac and Washington Mutual this is a risk many investors are shying away from. Many credible watchdog organizations already believe the major ETFs have partially backed some shares with derivatives instead of physical metals and are engaging in hidden leases, swaps, and commingling (risks that are even listed in some of the prospectuses for the ETFs)!

Finally, there are differences between the reporting requirements of ETFs or gold stocks and physical gold. Transactions and account openings must follow the stringent reporting requirements of FINRA and the SEC. By contrast, there are potentially no reporting requirements when buying or selling physical precious metals. This lack of paperwork makes the process more private and less burdensome than investments in gold ETFs.

Simply put, ETFs and gold stocks don’t insulate you from the risks inherent in the financial system. Although they can be useful to high-frequency traders, they are no substitute for owning physical gold and silver.

Physical Gold |

Gold ETFs |

|

| What are you buying? | The actual metal | Paper asset that tracks the spot price of gold |

| Fees | One-time dealer premium at purchase; no annual fee | Broker commissions in addition to 0.40% annual fee each year |

| Liquidity | Very liquid in both normal and abnormal market conditions; trades in large quantities nationally and globally; recognized as medium of exchange for all of history. | Very liquid in normal market conditions; illiquid in market crash: authorized partipants may stop all trading due to inability to insolvency or participant redempitons. |

| Counterparty Risk | No counterparty is involved. If stored in a private depository, this is the only counterparty | Counterparties include authorized partipicants (mega-banks), finanical exchange, London HSBC vault and brokers |

| Redemptions | Physical asset possesed by investory so no redemption necessary. If gold is stored in depository, metals can be redeemed at any time, including during a market crash. | No delivery option available for the average investor. If you are an authorized participant (a mega-bank) or possess $12.5 million of gold, requests for redemptions can be paid out in gold or in cash. |

| Reporting Requirements | Buying and selling physical gold itself potentially has no requirements. | Transactions and account opening must be reported under FINRA and the SEC. |