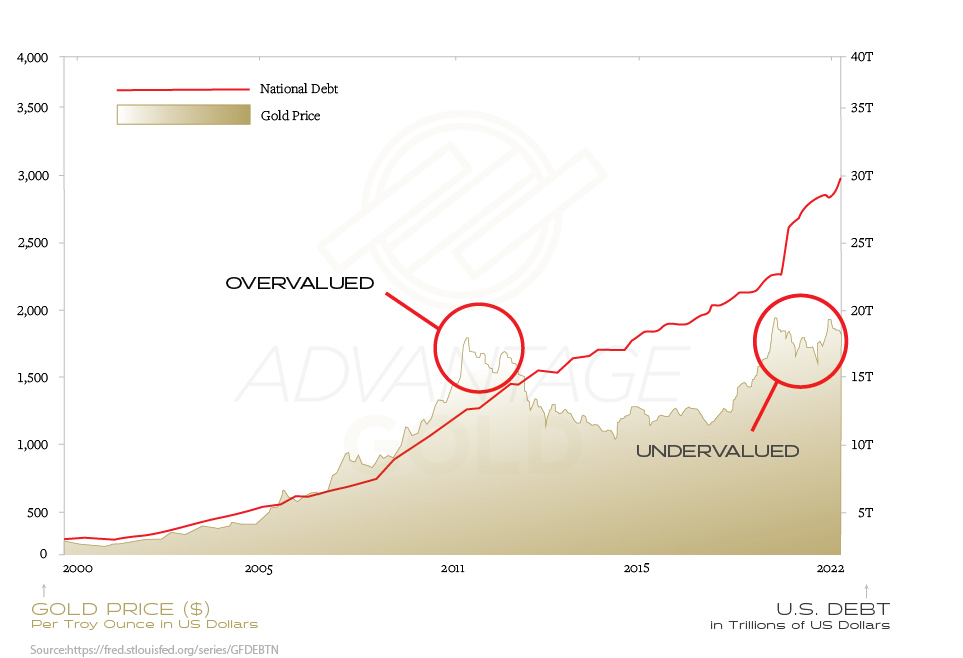

Overvalued or Undervalued

Since the year 2000, the price of gold has experienced significant fluctuations, while the national debt in the United States has grown alarmingly. At the beginning of the millennium, gold prices hovered around $280 per ounce. Still, they steadily increased over the next decade, reaching an all-time high of around $1,900 per ounce in 2011, overvalued compared to the National Debt. Multiple factors, including concerns about the stability of the global economy, geopolitical uncertainties, and a decline in the value of the US dollar, drove this increase. Conversely, the national debt in the United States has continued to rise, reaching over $30 trillion in 2022, representing more than a 400% increase since 2000.

Compared to the growth of the national debt, the price of gold seems undervalued, especially when considering gold’s historic role as a store of value and a hedge against inflation. However, the correlation between the national debt and gold prices implies that as the debt continues to grow, the value of gold should increase in response. However, the price of gold has kept pace with the escalating national debt, suggesting that its actual value needs to be accurately reflected in the current market price. Nevertheless, as the national debt continues to climb, gold’s undervaluation may eventually be recognized, leading to a potential increase in its price as investors seek a reliable store of value in an increasingly uncertain economic environment.