Investing in a Gold IRA: The Pros and Cons

There are pros and cons to every investment. Nothing is a sure thing, and you must consider many factors when deciding where to invest your money.

The Gold IRA is no exception.

Our goal is to educate you on how to invest in a Gold IRA and help you decide if investing in a Gold IRA is right for you.

What is a Gold IRA?

A Gold IRA is an individual retirement account allowing you to own physical gold and certain other precious metals as assets.

It is much like the traditional IRA, Self Employed Pension (SEP) IRA, or Roth IRA that you may already be familiar with, but with one significant difference: A Gold IRA is self-directed—meaning you pick and choose exactly what you want to invest in and how much.

When determining how to invest in a Gold IRA, consult your tax adviser or CPA and decide which plan is right for you.

The Current State of Gold Pricing

The price of gold is constantly changing. Some factors that affect gold prices are:

- Geopolitical risk

- Inflation

- Interest rates

- Stock market concerns

- World news

In August 1999, the price of gold was $251 per ounce. Since then, it has appreciated more than 650% to its August 2023 price of over $1,940 per ounce.

The price of gold peaked during the pandemic, reaching an all-time high of $2,075 per ounce in August 2020.

Still hovering near its all-time high during these inflationary times, many consider gold a safe-haven asset. Some see $1,900 to $2,000 as a new floor for the price of gold.

Many investors also feel a stock market correction and economic recession loom in the near future. Such events have typically boded well for the price of gold.

There have been eight recessions between 1973 and 2020. Gold has outperformed the S&P 500 in all of them except 1981 and 1990 except 1981 and 1990.

Inflationary periods seem to be another time when gold shines.

While we have felt the sting of inflation over the past several years, we’ve seen that gold historically does well when the stock market is suffering.

With countries at war, rising interest rates, inflation, and a possible recession on the horizon, gold may be perfectly positioned for a strong move to the upside.

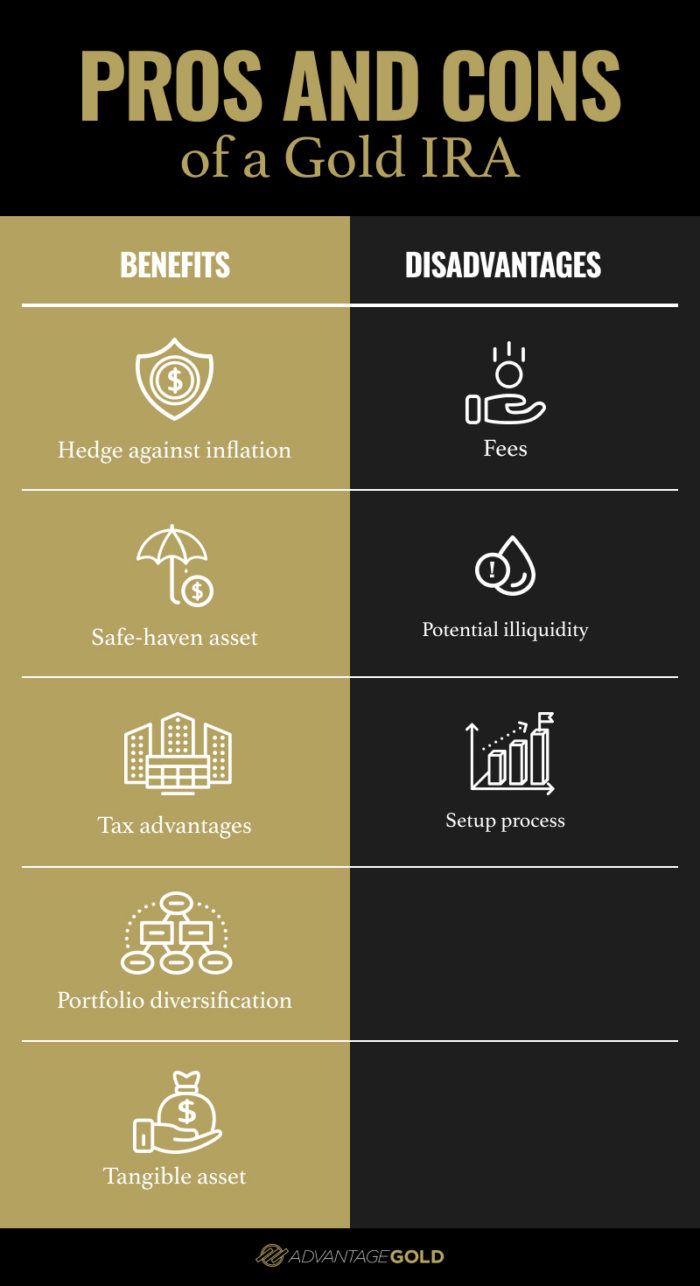

The Pros and Cons of Gold IRAs

That leads to one central question: Is a Gold IRA a good idea right now? It may seem that the timing is perfect, but timing is only one factor. Let’s examine the pros and cons of investing in a Gold IRA.

Gold IRA Benefits

Investors feel the need to own gold for many reasons, driving them toward investing in a Gold IRA. These factors include but aren’t limited to:

- A possible hedge against inflation

- Historically identified as a safe-haven asset

- Tax advantages

- Portfolio diversification

- A tangible asset

Hedge Against Inflation

There are multiple reasons that can explain why gold tends to perform well during periods of high inflation.

Gold is priced in dollars. As inflation edges product prices up, gold’s price usually follows suit. As with most products, there’s a decent chance the price of an ounce of gold today will be more than it cost to buy that ounce of gold yesterday. By owning gold, you can help preserve the purchasing power of your invested dollars.

Safe-Haven Asset

Linked to that same ideology of wealth preservation, investors often turn to gold as a safe-haven investment.

During recessions, stock market corrections, and inflation-heavy periods, investors often seek a safe shelter to park their funds. Many find gold, and increasingly, the Gold IRA, as perfect places to weather the storm and position themselves for future gains.

By securing your already invested funds by converting them into gold within your individual retirement account, you can protect them from a falling stock market and dollar and potentially see appreciation as those other products fall in value.

Tax Advantages

No matter the type, an IRA provides tax advantages. Investing in a Gold IRA offers those same advantages.

Traditional and SEP IRAs allow contributions on a pre-tax basis. Those contributions may be tax-deductible in the year made and contribute positively to your tax consequence.

Withdrawals are allowed after age 59 ½, when it is assumed that earned income will be less, and the impending taxes owed on the IRA funds will also be lower.

You’ll make Gold Roth IRA contributions with after-tax funds, and after age 59 ½, the withdrawals are tax-free.

A Diversified Portfolio

A Gold IRA can give you true diversification in your portfolio.

Gold is a separate asset class from stocks and can balance your asset allocation. It’s not correlated to the stock market.

Gold does not move up or down because other stocks are moving up or down. It tends to move up when stocks move down and tends to move down when stocks move up.

Tangible Assets

The gold you own in your Gold IRA is physical. Without much difficulty, you can arrange a visit to the depository and hold it in your hands.

Gold has had value for thousands of years and is unlikely to go to zero.

Gold IRA Disadvantages

Before investing in a Gold IRA, you should understand its disadvantages. While you may agree that these are easy to deal with, you should still prepare to acknowledge them. If you have concerns, a reputable Gold IRA company can help guide you through them and rectify any issues that arise with:

- Fees

- Potential illiquidity

- Setup process

Fees

Investing in a Gold IRA involves several fees. But many investors find the fees a small price to pay for the excellent services you get in return.

There is typically a custodial setup fee of less than $100. It is a one-time fee that you pay to establish the account.

Yearly fees can range from around $100 to almost $300. The price depends on whether you simply want to own precious metals in your portfolio or to own precious metals, stocks, bonds, and other allowable assets in the same account.

Keep in mind that the yearly fee includes all custodial responsibilities, such as:

- Sending account-owner statements

- Mandatory reporting to the IRS

- Ensuring only allowable activity happens inside the IRA

- Custodial safekeeping of all assets in the IRA

- Storing metals in the depository of your choice

- Insuring your stored metals

Potential Illiquidity

Because you will own actual physical gold inside your Gold IRA, you will eventually have to liquidate it, unless you decide to pass it onto future generations.

Typically, a physical gold owner must find a buyer, transport the metals, and enact a safe transaction. This can be frustrating to navigate.

Luckily, a trusted Gold IRA company can help alleviate these concerns.

Highly rated companies, such as Advantage Gold, have processes that eliminate the need for the account holder to do any of that.

Liquidations are normally handled in-house, and funds are deposited directly into your IRA. This eliminates the worry of withdrawing or taking large sums of cash.

Because of the strict guidelines enacted by the IRS, IRA-eligible coins are some of the finest and most recognizable in the world. If you decide to take possession, you can generally liquidate the coins or bars relatively easily.

The Setup Process

Individual retirement accounts take a small bit of time and effort to establish. You must complete the application process, fund your account, and choose and purchase your gold.

Although it might sound daunting, choosing the right Gold IRA company will alleviate the stress.

A seasoned Gold IRA firm—such as Advantage Gold—has trained account executives who will walk you through every step of the process. With their guidance, completing the application usually takes 30 minutes or less.

Their award-winning IRA department will liaise with the custodian to ensure that paperwork is submitted correctly.

This teamwork helps eliminate any delays in processing and assures a smooth transition into the Gold IRA.

Is a Gold IRA Good Idea for Your Portfolio?

As we’ve covered, a Gold IRA may be a good idea for your portfolio if you are looking for a:

- Hedge against inflation

- Safe-haven asset

- Tangible investment vehicle

- Portfolio diversifier

- Tax advantaged investment

While no two portfolios are the same, most investors are looking for time-tested safety and performance. Gold often offers both.

A Gold IRA may be the perfect way to fulfill your investment needs, and do it with funds that are already in your retirement account.

Consider Gold IRA Costs

Remember that you will incur fees with your Gold IRA. Though most consider them nominal for the extent of services provided, you must still consider the fee structure and be comfortable with it.

Understand Gold IRA Rules

With few exceptions, IRA funds are eligible for penalty free withdrawal at age 59 ½. This rule covers traditional, Roth, and SEP IRAs.

The IRS taxes eligible withdrawals from traditional and SEP IRAs as ordinary income in the year of the withdrawal.

Starting at age 73, you must begin withdrawals from traditional and SEP plans. You must take these required minimum distributions (RMDs) yearly. They aim to fulfill the unpaid tax liability of the IRA.

Eligible withdrawals from a Roth IRA are tax-free.

Because you contribute funds on an after-tax basis, a Roth IRA accumulates no unpaid tax liability. A Roth IRA has no period of RMDs, and you do not have to withdraw funds within a specific time frame.

Another important set of rules to remember with the Gold IRA pertains to precious metals.

The IRS mandates that IRAs contain only investment-grade gold. Gold coins and bars are only eligible if they meet the following conditions:

- Coins must be new, uncirculated, and in perfect physical condition

- Coins must come from government mints

- Proof coins must come in their original packaging and include a certificate of authenticity

- Gold must be 99.5% pure (with the exception of the American Gold Eagle Coin)

- Bars must come from approved manufacturers

These standards help eliminate speculative products and help ensure the long-term success of your investment.

Find a Custodian

Typically a bank, credit union, or non-depository bank, custodians must satisfy IRS standards to maintain custody of assets in an IRA. State and federal agencies heavily regulate custodians and oversee their processes.

The custodian executes the investment decisions you make for your IRA. It also ensures that all investment decisions are allowable and eligible for the IRA.

Long-standing Gold IRA companies typically have an ongoing relationship with one custodian. This ensures smooth dealings and familiarity with the systems of both companies.

Advantage Gold partners with Strata Trust as its custodian of choice. Strata is a Gold IRA industry leader with years of service to IRA gold owners.

Ready to Learn More About Gold IRAs?

After reviewing the pros and cons of investing in a Gold IRA, we hope you’ve gained a clear understanding of both.

While no investment is perfect or guaranteed, the Gold IRA’s advantages seem to dwarf the drawbacks.

Our trained account executives at Advantage Gold will walk you through the process and show you how easy it is to own physical gold in your portfolio.

Call today or send us your contact information, and we’ll get in touch.

We look forward to speaking with you and are happy to help.

Tags: is a gold ira a good idea